- Membership Resources

- State Chapters

- Education/Events

-

Advocacy/Policy

- Home Care Workforce Crisis: An Industry Report and Call to Action

- Advocacy Fund

- State of Home Care: Industry at Crossroads

- Home Care Workforce Action Alliance

- Caring for Seniors: Value of Home Care

- Home Care by the Numbers

- Issues & Positions

- Legislative Action Network

- State Legislation Tracker

- Federal Legislation Tracker

- 2024 National Advocacy Day

- About HCAOA

- Find a Job

The Better Medicare Alliance released its 2023 State of Medicare Advantage Report, which shows record-setting enrollment in Medicare Advantage plans. The report highlights several key findings, including the fact that in-home support services provided by Medicare Advantage plans increased 50% between 2022 and 2023. The average monthly premium for Medicare Advantage beneficiaries in 2023 is at a 16-year low of $18. Beneficiaries report spending significantly less on out-of-pocket costs and premiums annually, resulting in $2,400 in savings, which amounts to 44% less than other Medicare options. Medicare Advantage offers substantial value to both beneficiaries and the federal government, covering all Medicare-covered services for 24% less than Fee-For-Service (FFS) Medicare. Additionally, 95% of beneficiaries are highly satisfied with their coverage. Between 2022 and 2023, in-home support services increased 50%.

0 Comments

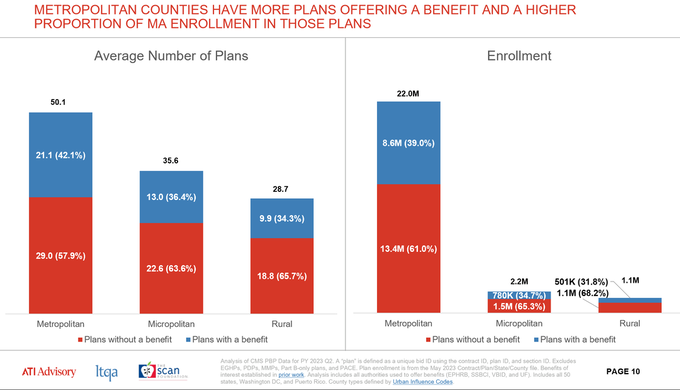

AARP's Long-Term Services and Supports (LTSS) 2023 State Scorecard Report was just released and reveals significant gaps in the care provided to older adults and individuals with disabilities in the United States. Although there has been some overall progress compared to the 2020 update, every state still has areas that require improvement.  Choices for Increased Mobility Act of 2023 H.R. 5371 is designed to enhance patient access to a wider range of wheelchairs. It allows for code upgrades for titanium and carbon fiber wheelchairs under Medicare. This legislation seeks to offer wheelchair users a choice of products that align with their medical and lifestyle needs and remove financial barriers that have prevented some Medicare beneficiaries from accessing titanium and carbon fiber mobility solutions. The bill has been introduced in the House and referred to the Committee on Energy and Commerce as well as the Committee on Ways and Means.  The U.S. Department of Health and Human Services (HHS) has successfully reenrolled nearly half a million children and families in Medicaid and Children’s Health Insurance (CHIP) coverage, fixing an error that was causing improper disenrollment. The Centers for Medicare & Medicaid Services (CMS) identified a state systems issue that was improperly disenrolling individuals, even when they remained eligible based on available information. CMS stated that measures were in place that would prevent further improper disenrollments. Last week, ATI Advisory, LTQA, and the SCAN Foundation released a report analyzing the variability in Medicare Advantage non-medical supplemental benefit offerings by geography and metro/non-metro areas. The goal of the analysis is to expand the stakeholder understanding of benefit offerings across the country. Included in the Executive Summary of the report is the most-commonly offered nonmedical benefits in metropolitan counties, which is Food & Produce (13 plans), while In-Home Support Services (IHSS) is the most common in micropolitan (8 plans) and rural counties (6 plans).

HCAOA has received member inquiries regarding CMS’ GUIDE initiative to improve the quality of life for people living with dementia. Home care organizations currently providing care to people with dementia have expressed an interest in participating in the CMS GUIDE Model, which will offer a standard approach to care, including 24/7 access to a support line, as well as caregiver training, education, and support services. This standard approach will allow people living with dementia to remain safely in their homes for longer by preventing or delaying nursing home placement and improving the quality of life for both people living with dementia and their unpaid caregivers.

An article entitled, “Price of elder care soars as demand increases, baby boomers age,” was published on TheHill.com on August 13, 2023. The article discusses how the cost of caring for aging or ailing family members in the U.S. has risen dramatically in recent years in nursing homes, assisted living facilities, and adult day centers. With insufficient support from programs like Medicare and Medicaid, many family caregivers are forced to deplete their limited funds to cover expenses. CMS announced it is addressing a data breach that occurred in Progress Software's MOVEit Transfer software on the corporate network of Maximus Federal Services, Inc. a contractor to the Medicare program. The breach involved personally identifiable information (PII) and protected health information (PHI) of Medicare beneficiaries. HHS and CMS confirm that no systems belonging to them were impacted by the breach. Letters are being sent to potentially affected individuals, notifying them of the breach and explaining the steps being taken in response. It is estimated that around 612,000 current Medicare beneficiaries may have been affected.

ATI Advisory recently released an analysis, in collaboration with the Better Medicare Alliance, demonstrating the impact of Medicare Advantage (MA) in addressing disparities among underserved communities. The study reveals a noteworthy trend, as Black and Asian Medicare-eligible beneficiaries exhibit a significantly higher preference for MA over Fee-for-Service (FFS) Medicare. This analysis illustrates the experiences of Medicare beneficiaries across different racial and ethnic backgrounds, shedding light on disparities and health equity opportunities. This research builds upon a Harvard Medical School and Inovalon study, emphasizing MA's role in serving socioeconomically disadvantaged demographics.

Celebrate National Immunization Awareness Month by sharing information about Medicare vaccine coverage. Thanks to a new prescription drug law that went into effect last year, as of January 1, 2023, the Medicare Part D drug plan now covers most vaccines at no cost. All adult vaccines recommended by the CDC’s Advisory Committee on Immunization Practices are now covered with no out-of-pocket costs. The Medicare drug plan won't charge a copay or apply a deductible for vaccines received like shingles, whooping cough, tetanus, and more. Earlier this week, CMS announced the Guiding an Improved Dementia Experience (GUIDE) Model, which aims to improve the quality of life for people living with dementia, reduce strain on unpaid caregivers, and help people remain in their homes and communities through a package of care coordination and management, caregiver education and support, and respite services. The GUIDE Model will be tested by the Center for Medicare and Medicaid Innovation and is a key deliverable from President Biden’s April 2023 Executive Order on Increasing Access to High-Quality Care and Supporting Caregivers, as well as key goals of the National Plan to Address Alzheimer’s Disease.

Last week, a new report by Avalere Health and commissioned by Better Medicare Alliance was released examining health outcomes and characteristics of Medicare Advantage and Fee-for-Service Medicare beneficiaries with certain chronic conditions, including hypertension, hyperlipidemia, and diabetes.

Medicare Advantage beneficiaries living in a metro area are more likely to be enrolled in a plan offering at least one supplemental service, such as in-home care, than in rural areas across the U.S., according to new data released last week by ATI Advisory. The data was presented during the biannual meeting of the Special Supplemental Benefits for the Chronically Ill (SSBCI) Leadership Circle, which HCAOA sits on alongside representatives from the Long-Term Quality Alliance (LTQA), the Administration for Community Living (ACL) under the U.S. Department of Health and Human Services, the SCAN Foundation, and others.

By Elizabeth E. Hogue, Esq.

Case managers/discharge planners continue to come under fire from fraud enforcers for violations of the federal anti-kickback statute. This statute generally prohibits anyone from either offering to give or actually giving anything to anyone in order to induce referrals. Case managers/discharge planners who violate the anti-kickback statute may be subject to criminal prosecution that could result in prison sentences, among other consequences.

|

Archives

July 2024

Categories

All

Upcoming Events |

|

Phone: 202-519-2960 | 444 N. Capitol Street NW, Suite 428 | Washington, DC 20001

[email protected] | sitemap © 2024 Home Care Association of America. All Rights Reserved. | Privacy Policy | Refund Policy |

|

RSS Feed

RSS Feed